|

|

|

|

|

By Lester R. Brown

Hydrologically, there are two Chinas—the humid south, which includes the Yangtze River basin and everything south of it, and the north, which includes all the country north of the Yangtze basin. The south, with 700 million people, has one third of the nation's cropland and four fifths of its water. The north, with 550 million people, has two thirds of the cropland and one fifth of the water. The water per hectare of cropland in the north is one eighth that of the south. The northern part of the country is drying out as the demand for water outstrips the supply. Water tables are falling. Wells are going dry. Streams are drying up, and rivers and lakes are disappearing. Under the North China Plain, a region that stretches from just north of Shanghai to well north of Beijing and that produces 40 percent of China's grain, the water table is dropping by an average of 1.5 meters per year. Farmers in the north are faced with losses of irrigation water both from aquifer depletion and from the diversion to cities and industry. Between now and 2010, when China's population is projected to grow by 126 million, the World Bank projects that the nation's urban water demand will increase from 50 billion cubic meters to 80 billion, a growth of 60 percent. Industrial water demand, meanwhile, is projected to increase from 127 billion cubic meters to 206 billion, an expansion of 62 percent. In much of northern China, this growing demand for water can be satisfied only by taking irrigation water from agriculture.

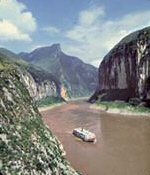

The Yellow River, the northernmost of the country's two major rivers, is being overused. After flowing uninterruptedly for thousands of years, this cradle of Chinese civilization ran dry in 1972, failing to reach the sea for some 15 days. In the following years, it ran dry intermittently until 1985. Since then, it has run dry for part of each year. In 1997, a drought year, the Yellow River failed to reach the sea for 226 days. In fact, during much of 1997 the river failed to reach Shandong Province, the last of the eight it flows through en route to the sea. Shandong, producing a fifth of China's corn and a seventh of its wheat, is more important to China than are Iowa and Kansas together to the United States. Half of the province's irrigation water used to come from the Yellow River, but this supply is now shrinking. The other half comes from an aquifer that is falling by 1.5 meters per year. As more and more water is diverted to industry and cities upstream, less is available downstream. Beijing is permitting the poverty-ridden upstream provinces to divert water for their development at the expense of agriculture in the lower reaches of the basin. Among the hundreds of projects to divert water from the Yellow River in the upper reaches is a canal that will take water to Hohhot, the capital of Inner Mongolia, starting in 2003. This additional water will help satisfy swelling residential needs as well as those of expanding industries, including the all-important wool textile industry that is supplied by the region's vast flocks of sheep. Another canal will divert water to Taiyuan, the capital city of Shanxi province, a city of some 4 million that has recently been forced to ration water. The growing upstream claims on the Yellow River mean that one day it may no longer reach Shandong Province at all, depriving the province of roughly half of its irrigation water. The resulting prospect of massive grain imports and growing dependence on U.S. grain, in particular, leads to sleepless nights for political leaders in Beijing.

Immediately to the north of the Yellow River basin is the Hai River basin, which has over 100 million people and includes Beijing and Tianjin, both large industrial cities. Water use in the basin currently totals 55 billion cubic meters annually, while the sustainable supply totals only 34 billion cubic meters. This annual deficit of 21 billion cubic meters is being satisfied largely by groundwater mining—by overpumping. Once the aquifer is depleted, water pumping will necessarily drop to the sustainable yield, cutting the water supply by nearly 40 percent. Given rapid urban and industrial growth in the area, irrigated agriculture in the basin could largely disappear by 2010, forcing a shift back to less productive rainfed agriculture.

Immediately to the north of the Yellow River basin is the Hai River basin, which has over 100 million people and includes Beijing and Tianjin, both large industrial cities. Water use in the basin currently totals 55 billion cubic meters annually, while the sustainable supply totals only 34 billion cubic meters. This annual deficit of 21 billion cubic meters is being satisfied largely by groundwater mining—by overpumping. Once the aquifer is depleted, water pumping will necessarily drop to the sustainable yield, cutting the water supply by nearly 40 percent. Given rapid urban and industrial growth in the area, irrigated agriculture in the basin could largely disappear by 2010, forcing a shift back to less productive rainfed agriculture.

Meanwhile, as China's economy expands at a projected annual rate of 7 percent, as it adds 12 million people a year, and as Chinese eat more grain-fed meat, the country's need for grain will continue to grow. This, coming at a time when grain production will be falling in key producing regions as water shortages intensify, could quickly make China the world's leading grain importer, overtaking even Japan. Water shortages can be ameliorated by using water more efficiently, but in China this is not always easy. A recent government strategy paper indicates that this means raising water prices to an “appropriate” level, one much closer to market value. For Beijing, this option is fraught with political risks because the public response to raising water prices in China is akin to that of raising gasoline prices in the United States. Recent policy decisions indicate the direction in which China is planning to move. For one, China has officially abandoned its longstanding policy of grain self-sufficiency. After raising the grain support price some 42 percent in 1994 in a valiant effort to remain self-sufficient, the leaders in Beijing have since acknowledged that the fiscal cost was too high, and they are permitting the price of grain to fall toward world market levels. They have also announced that in the competition for water, cities and industry get priority—leaving agriculture last. China is not alone in facing water shortages. Other countries where water scarcity is raising grain imports or threatening to do so include India, Pakistan, Iran, Egypt, Mexico, and dozens of smaller countries. But only China—with nearly 1.3 billion people, a fast-growing economy, and a $40-billion-plus trade surplus with the United States—has the potential to disrupt world grain markets. In short, falling water tables in China could soon mean rising food prices for the entire world. |

© 1997-2000 BEI

In 1999 the water table under Beijing fell by 2.5 meters (8 feet). Since 1965, the water table under the city has fallen by some 59 meters or nearly 200 feet, warning China's leaders of the shortages that lie ahead as the country's aquifers are depleted.

In 1999 the water table under Beijing fell by 2.5 meters (8 feet). Since 1965, the water table under the city has fallen by some 59 meters or nearly 200 feet, warning China's leaders of the shortages that lie ahead as the country's aquifers are depleted.